Protect Your Business with Risk Management Talent

Wise investment decisions, regulatory compliance, and financial stability all hinge on top risk management expertise. With market and regulatory pressures intensifying, firms are vying for the same risk management talent, making it harder to secure specialists who can protect your business from evolving risks.

Stay ahead of the competition and secure the risk management talent you need with Selby Jennings.

Risk management talent services, bespoke to you

Hiring for your business

Selby Jennings specializes in risk management recruitment, placing niche, hard-to-find risk professionals through several talent solutions, tailored to your organization's unique needs.

Looking for a new role?

Considering a career move? Selby Jennings connects you with new risk management opportunities that match your personal and professional goals, supporting you throughout the hiring process.

Enhancing & adding value

We make it our business to offer you more than risk management recruitment. Discover the value-added services we provide that help you to make hiring or career decisions with confidence.

Securing tomorrow's talent

Complex regulations, digitalization and shifts in the lending and economic environment have dramatically increased the demand for skilled risk managers.

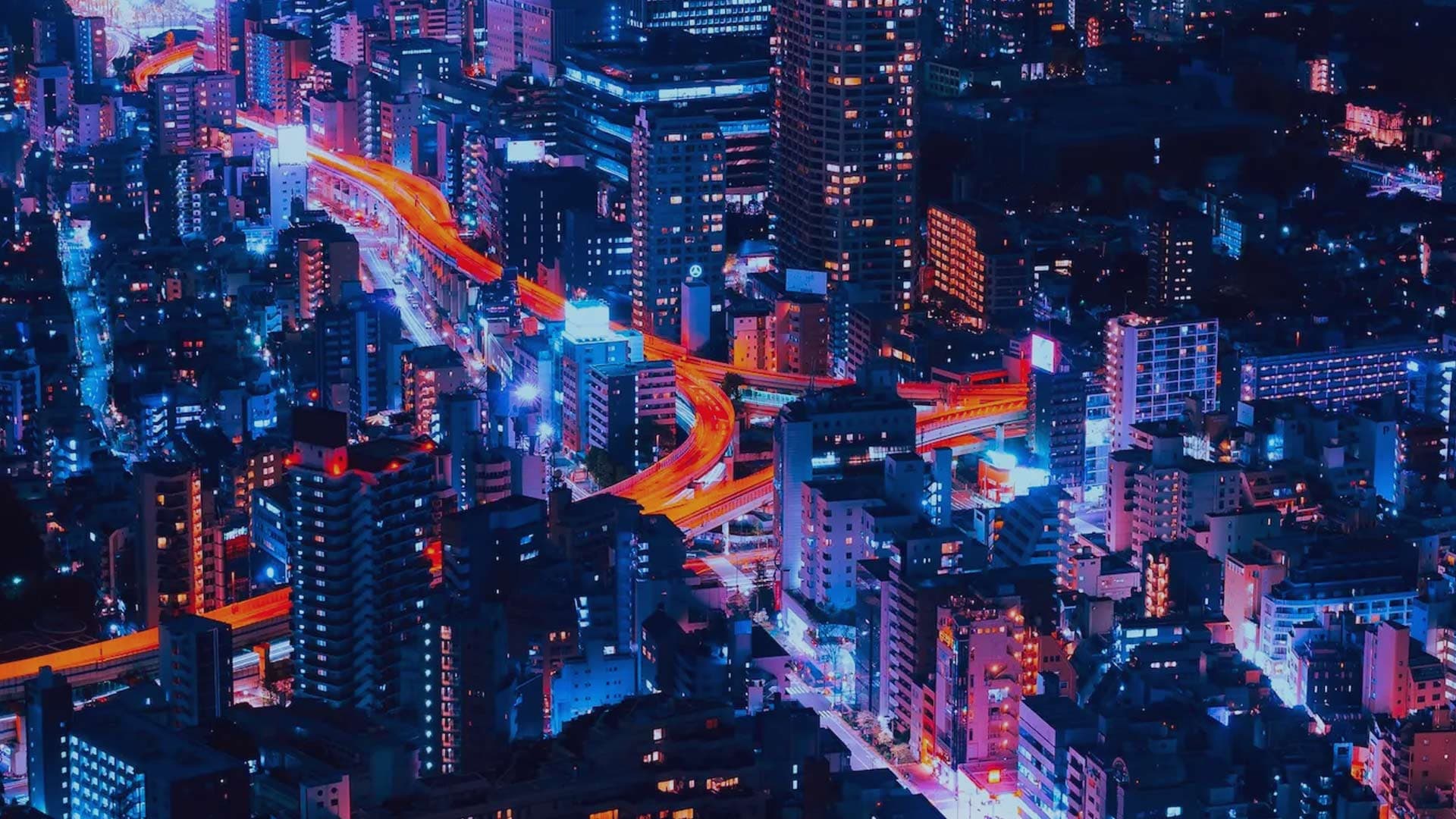

As a leader in risk management recruitment, Selby Jennings' unmatched market knowledge, presence in all key financial hubs, and specialist recruitment expertise ensures we source the exact talent needed to protect your firm from these evolving risks – whenever and wherever you need it.

Our tailored risk management recruitment services have led to successful placements across financial hubs worldwide.

Discover key roles and the types of companies we support here:

- Corporate, Investment & Retail Banks

- Fintechs

- Insurance

- Asset & Investment Management Firms

- Energy & Commodities Firms

- Consultancies

- Prop Trading Firms & Hedge Funds

- Crypto Shops & Exchanges

- Chief Risk Officers

- Market Risk Managers (across all asset classes)

- Model Risk Management & Risk Modeling

(Market, Counterparty, AI/ML, Retail, Wholesale, Liquidity, Fraud) - Liquidity Risk Managers (1st & 2nd Line)

- Credit Risk Managers (Retail & Wholesale)

- Technology, Operational, & Enterprise Risk Managers

- Chief Credit Officers

- Buy Side Risk Managers (Prop Trading, Hedge Funds,

Asset Managers, Investment Firms, Commodity Trading Houses) - Fraud Risk

- Data Science

- Corporate Treasury (1st & 2nd line)

- Prime Brokerage Risk Managers

- Risk Advisory, Risk Reporting, & Risk Consulting

CLIENT TESTIMONIALS

Looking to hire?

Discuss your hiring needs and get a tailored plan to source top risk management talent quickly and accurately.

Looking for a new role?

Working with organizations from fintechs to corporate banks and everything in between, find your next career-defining job in risk management today.

Explore our financial sciences & services expertise

No market is the same, which is why we have talent experts dedicated solely to the following specialisms: